Advertising And Marketing Media Spend Grew By 11%

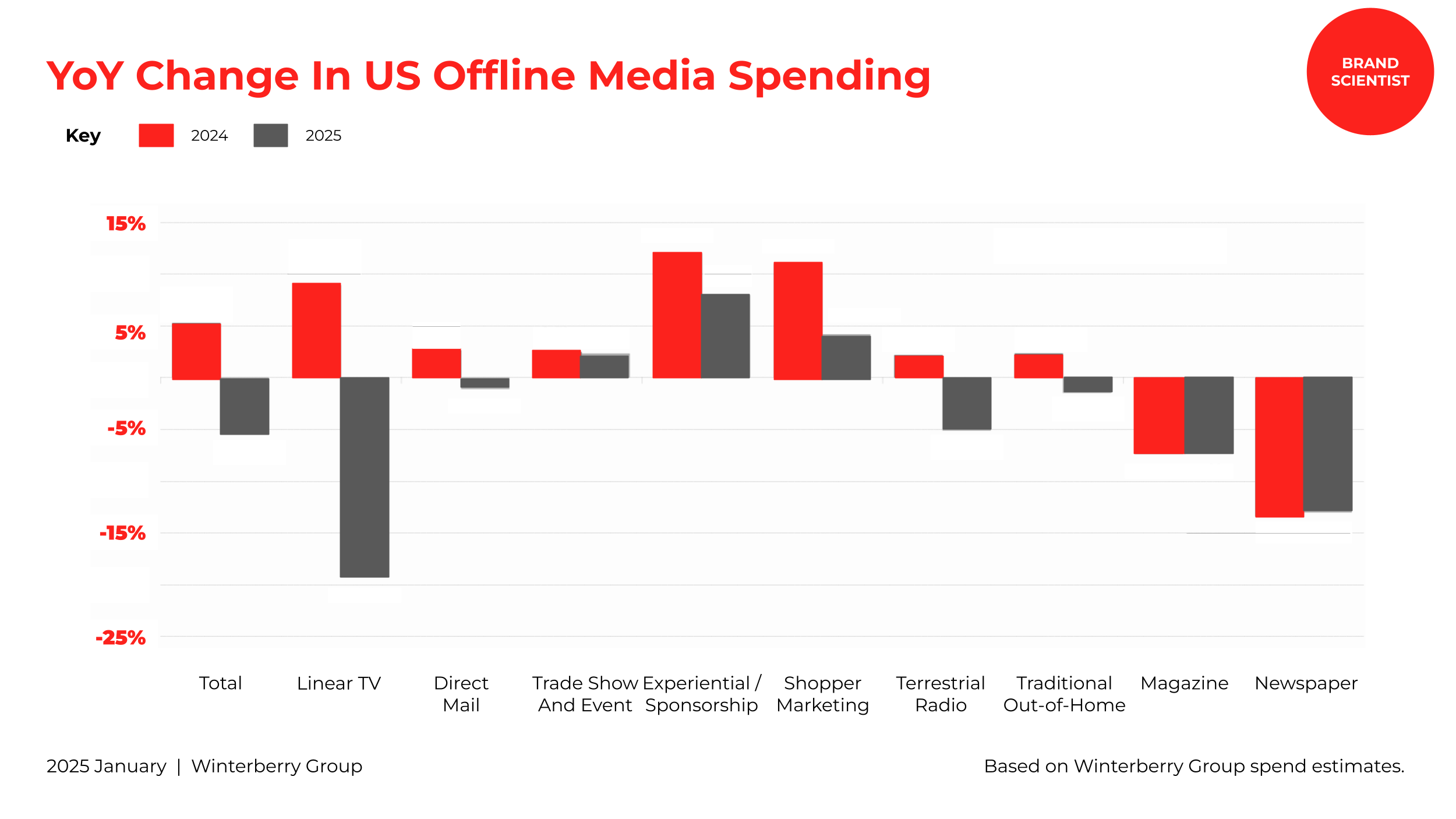

The US advertising and marketing media spend grew by 11% in 2024, reaching $551.9 billion, with offline media contributing $191 billion after experiencing a modest 5.3% growth. However, offline media spending remains in a long-term decline, falling to 34.6% of total ad spend, down from 37.9% in 2023 and nearly 50% in 2020. While offline media rebounded slightly in 2024, projections indicate a sharp 5.5% decline this year, even as online marketing spend is expected to grow by 12.3%, further accelerating the digital transition.

Among offline media, linear TV saw an 8.9% increase in spending in 2024, but its total ($58.9 billion) was surpassed for the first time by combined digital video and CTV ad spend ($59.3 billion). A significant 19.3% decline in linear TV spending is forecast for 2025, marking the largest drop among any media category. Direct mail saw a slight recovery (+2.6%) but is expected to decline by 1.1% this year, while trade show and event spending has fully rebounded to pre-COVID levels and is projected to grow by 2.3%.

Experiential and sponsorship marketing experienced the fastest offline growth last year at 12%, outpacing forecasts. This trend is set to continue, with an anticipated 8% increase this year. Shopper marketing, including in-store displays and retail promotions, also grew significantly (+11%) and is expected to continue expanding (+4.2%). However, traditional radio, print newspapers, and magazines remain in decline. Radio spending grew slightly (+2.2%) in 2024 but is forecast to shrink by 5.1% this year, while print newspapers (-13%) and magazines (-7.3%) continue to lose advertiser interest.

Overall, the data highlights a continued shift away from traditional media toward digital channels. While some offline formats, such as experiential marketing and trade shows, are thriving, others—especially linear TV and print—are seeing accelerated declines. Marketers need to adapt by diversifying their strategies, balancing digital investments with select offline channels that still offer engagement opportunities.

Key Actionable Takeaways:

Emphasize Digital-First Strategies – With online ad spend growing 12.3% in 2025, prioritize digital channels, especially video, CTV, and display advertising.

Diversify Media Investments – While offline media is declining, certain channels like experiential marketing and trade shows are growing—invest in these areas strategically.

Prepare for Linear TV’s Decline – As linear TV ad spend drops sharply, shift budgets toward digital video and CTV to maintain audience reach.

Capitalize on Experiential and Sponsorship Growth – With 8% growth expected, invest in event-based marketing to foster deeper audience engagement.

Optimize Direct Mail for Targeted Campaigns – Despite a slight expected decline, direct mail remains an effective tool when used in personalized, data-driven marketing efforts.

Leverage Trade Shows for B2B Engagement – With trade show spending rebounding, ensure a strong presence at industry events to drive brand visibility and lead generation.

Shift Print Budgets to Digital Alternatives – With newspapers and magazines experiencing double-digit declines, explore digital-native publications and programmatic ad buys.

Adapt Audio Strategies – As digital audio ad spend grows (+10.1%), invest in podcast sponsorships and streaming audio ads to engage modern audiences.

Enhance Retail and Shopper Marketing – With continued growth in in-store promotions, invest in retail media networks and point-of-sale activations.

Monitor Emerging Offline Trends – While traditional media struggles, niche opportunities in experiential marketing, local activations, and hybrid media models could provide unique advantages.