Mid-2024 Consumers' Intentions To Spend

Consumer financial sentiment is stabilizing, with 30% of respondents feeling better off financially than last year, nearly matching the 32% who feel worse off, according to NielsenIQ’s latest survey. This is a notable improvement from mid-2022, when a 12-point gap existed between those who felt financially worse off versus better off. Despite this narrowing gap, financial caution remains prevalent, with 54% of consumers prioritizing essential purchases and 43% spending more time at home to save money. Overall, consumer spending behaviors remain conservative, with trends indicating continued cutbacks in discretionary spending while essential costs like utilities and childcare remain high priorities.

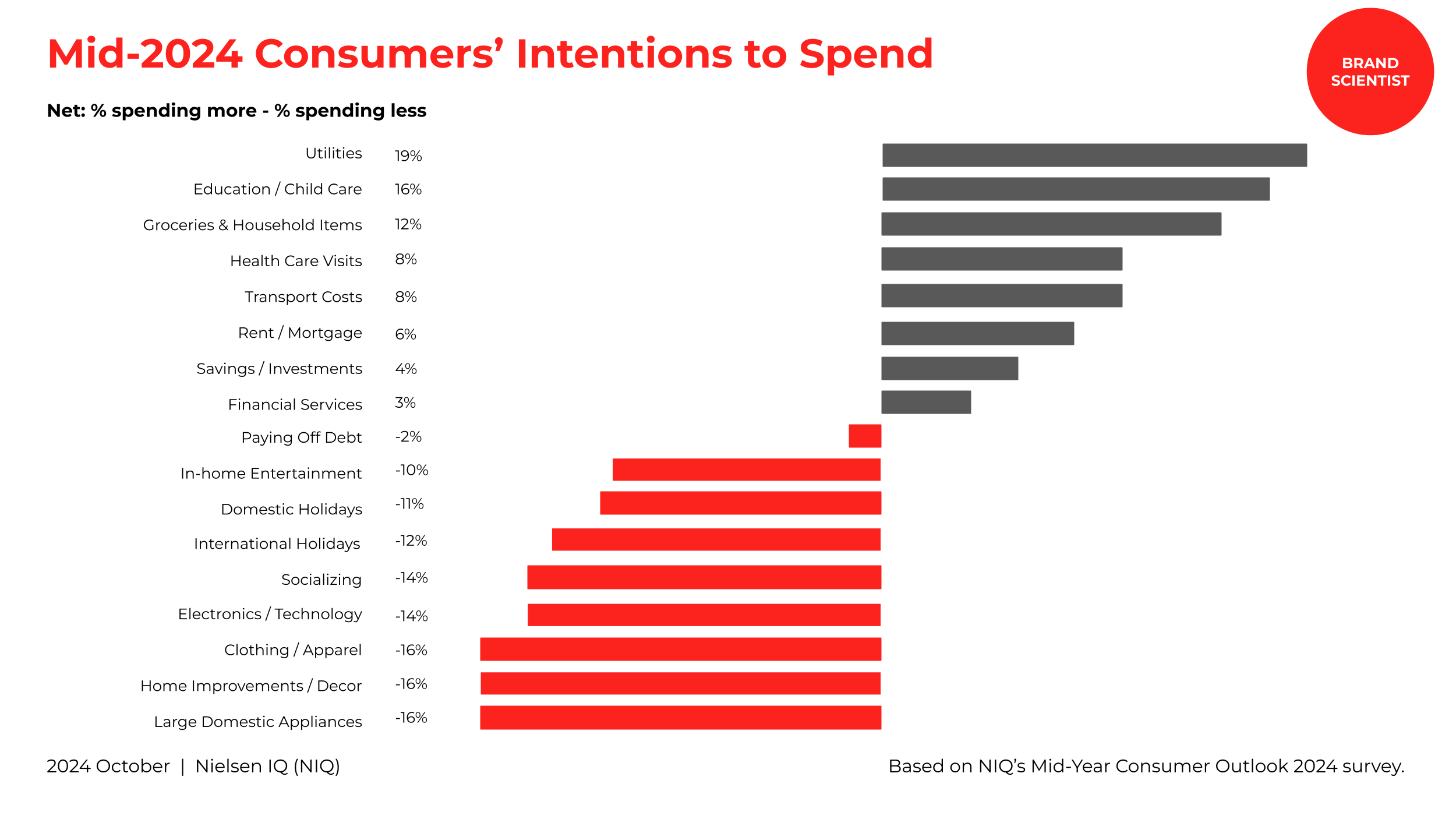

Out-of-home (OOH) entertainment remains the biggest area for spending cuts, with a net negative intent of -21%, while OOH dining has seen a slight recovery, improving from -25.8% to -19.1%. However, consumer spending sentiment on in-home entertainment (-10.4%), socializing (-13.7%), and holiday celebrations (-16.8%) has declined further. Meanwhile, utilities remain the top spending priority, with a net positive spending intent of +18.9%, followed by education and childcare (+15.5%). Interestingly, healthcare spending intent has dropped sharply from +15.8% to +8.2%, indicating possible shifts in affordability or access concerns.

Consumers are becoming more price-sensitive and brand-agnostic, with 67% willing to switch brands for a lower price. Many shoppers are turning to bulk purchases (65%) and private label brands, which saw record sales in 2023. Additionally, 62% of consumers—especially Millennials (65%) and Gen Z (higher than older generations)—are opting for at-home experiences over restaurants and entertainment venues. The demand for economical, convenient, and larger-pack options is growing, as many consumers expect brands to offer cost-effective solutions to combat rising prices. At the same time, 56% are willing to splurge on making one day a week more enjoyable, with younger generations driving this trend.

Key Actionable Takeaways:

Highlight Value and Affordability – As consumers cut discretionary spending, emphasize cost-effectiveness, promotions, and affordability in marketing campaigns.

Leverage Bulk and Economy Sizing – With 65% of consumers preferring larger pack sizes, brands should introduce or highlight economy-sized products with lower cost per usage.

Promote Private Label and Store Brands – With more consumers switching to private label options, retailers should expand and market store-brand offerings to capitalize on this growing trend.

Target the ‘Home Experience’ Economy – With 62% of consumers investing in at-home experiences, brands can create DIY kits, entertainment bundles, or home-themed product promotions.

Adjust Messaging by Generation – Millennials and Gen Z are more willing to spend on experiences and convenience, while Boomers prioritize practicality and cost savings—tailor messaging accordingly.

Position In-Home Entertainment as an Alternative to OOH – As OOH entertainment spending declines, brands should market streaming services, gaming, and home entertainment products as cost-effective alternatives.

Maintain Flexibility with Pricing and Promotions – With 67% of consumers switching brands for price, ensure competitive pricing, loyalty incentives, and discount programs to retain customers.

Monitor Healthcare Spending Trends – As healthcare spending intent declines, brands in the wellness and healthcare space should adjust offerings, pricing, or benefits messaging.

Encourage Small Luxury Moments – Since 56% of consumers are willing to splurge occasionally, brands can position products as part of affordable indulgence experiences.

Capitalize on Seasonal and Holiday Trends – Even though holiday spending sentiment is declining, brands should create budget-friendly celebration solutions that encourage spending while offering value.