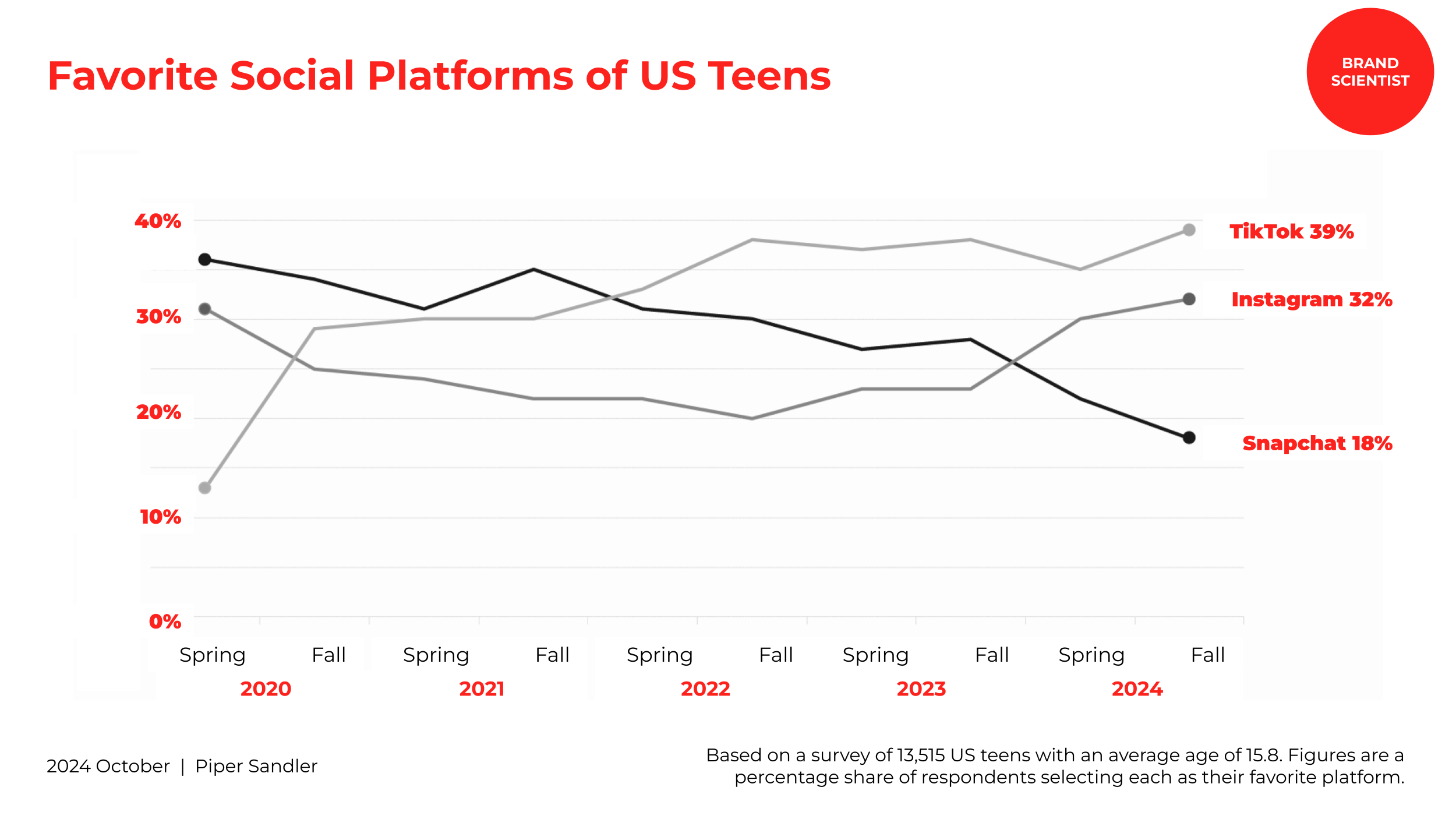

Favorite Social Media Platforms of US Teens

TikTok remains the most popular social media platform among US teens, with 39% naming it their favorite, according to Piper Sandler’s Fall 2024 "Taking Stock with Teens" report. This marks an increase from 35% in Spring 2024, representing TikTok’s highest recorded popularity since it was first included in the survey in 2020. Despite TikTok’s dominance, Instagram has also surged in popularity, with 32% of teens naming it their favorite, up from 30% in the Spring and 23% a year ago. Notably, Instagram’s monthly usage rate has reached 87%, its highest level since the survey began in 2016. TikTok follows closely at 79%, while Snapchat’s monthly usage has declined to 71% (down from 74% in Fall 2023).

Snapchat’s overall favorability is also dropping, with only 18% of teens naming it their favorite platform, down from 22% in the Spring and 28% a year ago. Meanwhile, Pinterest (41%) is now used more frequently than X/Twitter and Facebook (both at 30%), showing that visual-based platforms continue to resonate with younger audiences. In the battle for teen video consumption, Netflix (30%) has slightly extended its lead over YouTube (27%) for daily watch time.

Beyond social media, Apple continues to dominate teen tech preferences, with 87% of teens owning an iPhone (up from 85% in Spring 2024), and nearly 30% planning to upgrade their devices within the next six months to take advantage of Apple Intelligence features. Teen spending habits are also increasing, with self-reported spending up 4% from Spring 2024 and 6% year-over-year. In the retail space, Nike remains the top brand for both apparel and footwear, though it has lost some ground in the footwear category. Amazon continues to be the top shopping destination for upper-income teens, reinforcing its dominance in e-commerce for younger consumers.

Key Actionable Takeaways:

Prioritize TikTok and Instagram in Marketing Strategies – With TikTok (39%) and Instagram (32%) leading teen preferences, focus on short-form video content, influencer collaborations, and interactive campaigns.

Leverage Instagram’s Growing Engagement – Instagram’s record-high usage (87%) means brands should invest in Reels, Stories, and shoppable content to capture teen audiences.

Monitor Snapchat’s Decline and Shift Budgets Accordingly – With Snapchat losing favor, consider adjusting ad spend toward platforms with stronger engagement like TikTok and Instagram.

Capitalize on Pinterest’s Strength – As Pinterest sees higher monthly usage than X/Twitter and Facebook, brands targeting Gen Z should explore visual search, trend-based content, and shopping integrations.

Optimize Video Content for Netflix and YouTube Viewers – Since Netflix (30%) remains the top platform for daily video consumption, brands should explore product placements, influencer partnerships, and branded content on these platforms.

Target Apple Users in Tech Marketing – With 87% of teens owning iPhones and 30% planning upgrades, marketers should integrate Apple-focused campaigns and leverage iOS-exclusive features in their digital strategies.

Tap Into Teen Spending Growth – With self-reported spending up 6% YoY, brands should focus on affordable luxury, limited-edition drops, and personalized offers that appeal to Gen Z’s spending habits.

Strengthen Nike & Footwear Competitor Strategies – While Nike remains dominant, its decline in footwear popularity presents an opportunity for competing brands to gain market share with innovative, trend-driven designs.

Enhance E-Commerce Strategies with Amazon in Mind – Since Amazon is the top choice for upper-income teens, brands should optimize Amazon listings, influencer collaborations, and exclusive drops to attract Gen Z shoppers.

Leverage Apple Intelligence in Future Marketing Efforts – As Apple rolls out AI-driven features, explore how AI-based personalization, voice search optimization, and app integrations can enhance digital experiences for teen consumers.