The Anchoring Effect

Excerpt - Heading 3

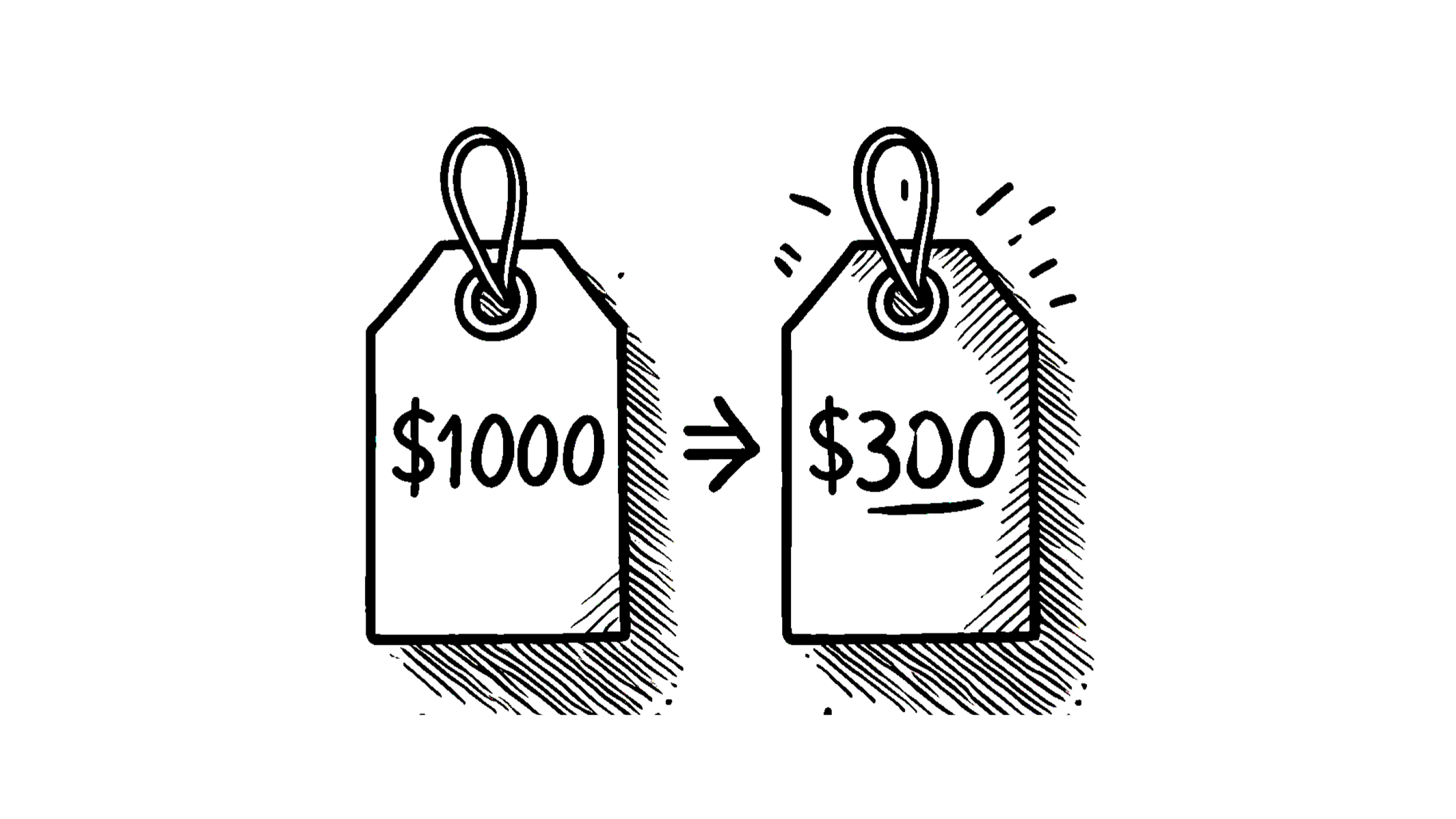

Imagine you walk into a store and see a jacket priced at $500. At first, it seems a bit expensive, but then you notice a similar jacket marked down to $200. Suddenly, $200 doesn’t seem so bad. This feeling you have is the "anchoring effect." It's a psychological trick our brains play where we rely heavily on the first piece of information we receive (the “anchor”) to make judgments about everything that follows. In this case, the $500 jacket acts as the anchor that makes $200 seem like a bargain. This phenomenon is often used in pricing strategies to make customers feel like they’re getting a deal.

Background

The anchoring effect was first introduced by psychologists Amos Tversky and Daniel Kahneman in the early 1970s. Their work focused on understanding how humans make decisions under uncertainty. The anchoring effect suggests that the initial price or value we see in a decision-making process will influence our perceptions, even if that initial price is irrelevant to the decision itself. The concept became foundational in the field of behavioral economics, influencing how companies design pricing strategies to steer consumer behavior.

Historical Experimentation

One of the most famous experiments demonstrating the anchoring effect was conducted by Tversky and Kahneman in 1974. The experiment was called “The Anchoring Heuristic in Decision Making,” and it was published in the Science journal. In the experiment, participants were shown a wheel of fortune with numbers ranging from 0 to 100. They were then asked to estimate the percentage of African nations in the United Nations. Those who saw a higher number on the wheel tended to estimate a higher percentage, even though the number was completely unrelated to the task. The results revealed that the starting point (the anchor) had a significant influence on the final estimate, illustrating how easily our judgments can be swayed by initial information.

Connection to Human Evolution/Biology/Neuroscience

From an evolutionary perspective, the anchoring effect may have roots in our brain's reliance on quick, efficient decision-making processes. Our ancestors needed to make fast decisions for survival, often relying on the first piece of information they encountered as a shortcut. This “cognitive shortcut” helped them make judgments under pressure, but it can also lead us to make biased decisions in modern contexts. Neuroscientifically, the anchoring effect is thought to be tied to how our brains process information. The brain's reliance on heuristics (mental shortcuts) is rooted in the basal ganglia, which helps process reward and decision-making, often leading us to overvalue initial data points.

Recent Research & Experimentation

More recent studies have continued to explore the anchoring effect in different settings. For example, in 2006, researchers at the University of Colorado Boulder conducted an experiment on how anchoring affects real estate pricing. They found that when an initial listing price was set high for a home, it had a lasting impact on potential buyers' perceptions of the house’s value, even after price reductions. This study, published in the Journal of Behavioral Decision Making, expanded on the idea that anchors don’t just influence immediate decisions, but they can also create long-term perceptions of value. Additionally, studies have shown that anchoring can influence everything from salary negotiations to restaurant tips, showing its wide-reaching impact in consumer behavior.

Conclusion

Understanding the anchoring effect is a powerful tool in pricing strategy. If you're selling products, you can strategically set higher initial prices to make subsequent offers appear more appealing. For example, when offering a high-ticket item, it can make a mid-range product seem like a bargain in comparison. Similarly, in retail, presenting a "premium" version of a product at a high price can anchor customers to see the lower-priced version as more reasonable. By leveraging the anchoring effect, businesses can guide consumers toward more profitable decisions, making it an essential tool for pricing strategy.

More Behavioral Science

How Posting at the Right Moment Makes Content More Likely to Go Viral